reverse tax calculator quebec

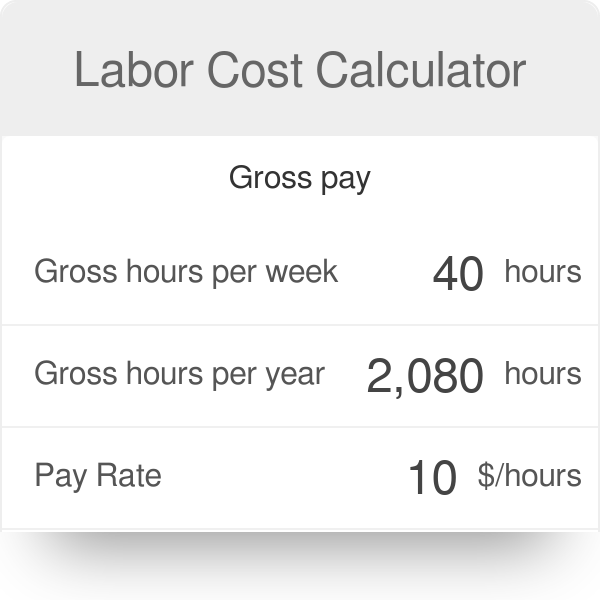

This rate may be rounded off to 997 only if your cash register cannot process three-decimal numbers. Below is a table of common values that can be used as a quick lookup tool for a sales tax rate of 14975 in Quebec Canada.

New Google User Interface Updates Refine Layers Mini Carousels Shopping Toggle Mortgage Calculator More Online Mortgage Mortgage Payment Calculator Mortgage Calculator

2022 free Canada income tax calculator to quickly estimate your provincial taxes.

. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. 1991 goods and services tax GST was introduced in AustraliaAll transactions after this affective date are to. Type of supply learn about what supplies are taxable or not.

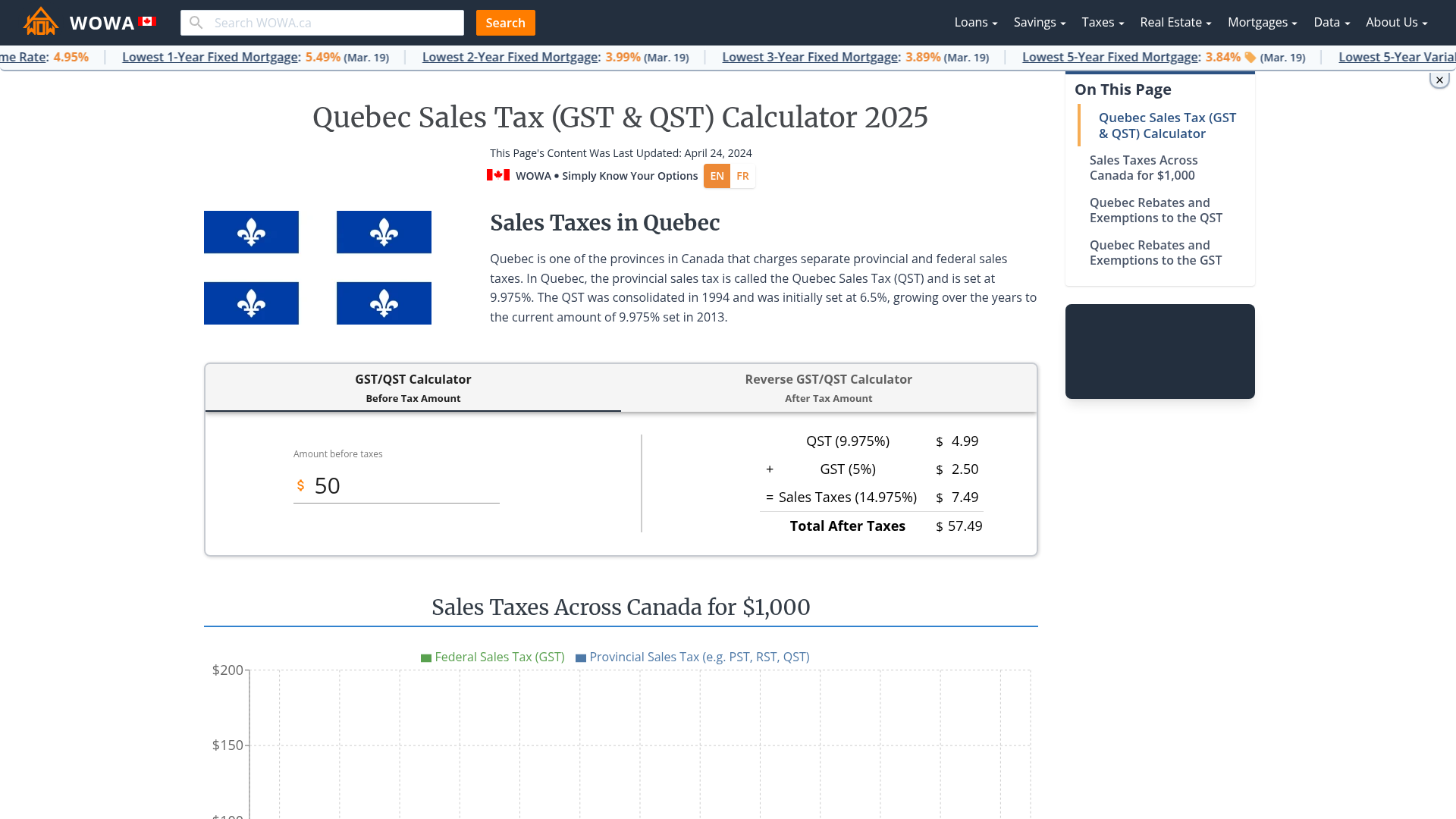

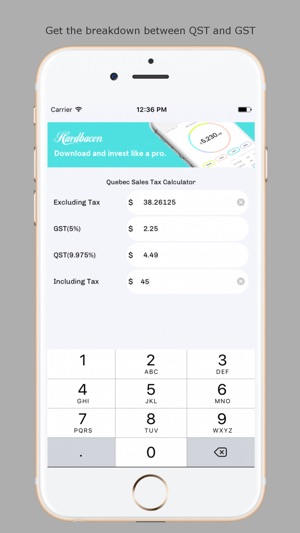

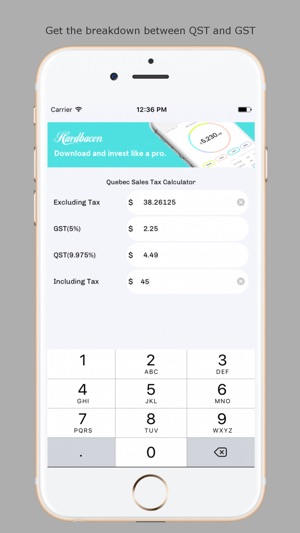

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Alberta tax brackets and rates. The rate you will charge depends on different factors see.

Quebec income tax calculator. Who the supply is made to to learn about who may not pay the GSTHST. In Quebec the provincial sales tax is known as Quebec sales tax.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The Quebec Income Tax Salary Calculator is updated 202223 tax year. Your average tax rate is 220 and your marginal tax rate is 353.

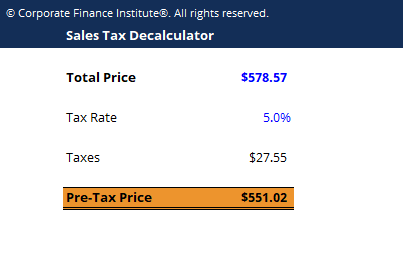

Reverse HST Calculator Input. HST value and price without HST will be calculated automatically. Reverse GSTQST Calculator After Tax Amount.

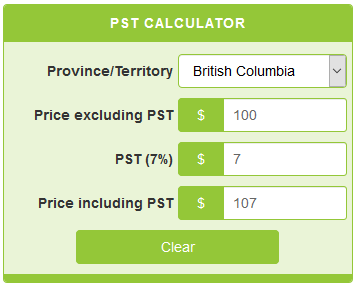

How to use HST Calculator for reverse HST Calculation. Average of tax. This simple PST calculator will help to calculate PST or reverse PST.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. To use the tool. Saskatchewan income tax calculator.

From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. The following table provides the GST and HST provincial rates since July 1 2010. Enter HST inclusive price on the bottom.

The period of reference or the tax year used in this tool is from january 1st 2022 to december 31 2022. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. WebRAS is now the tool to use to calculate source deductions and employer contributions.

In Quebec merchants have to pay GST and QST for all the sales madeCalculate you sales tax. Subtract the price of. Amount with sales tax 1 HST rate100 Amount without sales tax.

Reverse HST Calculator Result. The only thing to remember in our Reverse Sales. Montant sans taxes Taux TPS Montant de la TPS.

GSTguide Canadian GST Calculator provides GST calculators for several countries like Canada Australia Egypt India New Zealand Singapore. Voici la façon dont est calculé le montant avant taxe. Please enter your income deductions gains dividends and taxes paid to.

Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Your average tax rate is 293 and your marginal tax rate is 438.

That means that your net pay will be 36763 per year or 3064 per month. This marginal tax rate means that your immediate additional income will be taxed at this rate. That means that your net pay will be 40568 per year or 3381 per month.

Yukon income tax calculator. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Reverse Sales Tax Formula.

WebRAS 2020 2021 and 2022. GSTQST Calculator Before Tax Amount. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013.

The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. WebRAS must be used with the Guide for Employers. This will give you the items pre-tax cost.

Now you divide the items post-tax price by the decimal value youve just acquired. Where the supply is made learn about the place of supply rules. Formula for reverse calculating HST in Ontario.

Calculate the total income taxes of a Quebec residents for 2022. 2675 107 25. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to.

Montant sans taxes Taux TVQ Montant de la TVQ. If youre looking for a reverse GST-only calculator the above is a great tool to use. You must use the 9975 rate to calculate the QST if your cash register calculates the GST and QST in two steps that is if it calculates 5 GST on the sale price then also calculates the QST on the sale price.

Tax brackets and rates. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. To calculate the total amount and sales taxes from a.

All numbers are rounded in the normal fashion. Reverse GST Calculator. Divide the price of the item post-tax by the decimal value.

Calculates the canada reverse sales taxes HST GST and PST. Current Provincial Sales Tax PST rates are. It can be used as well to reverse calculate Goods and Services tax calculator.

Source Deductions and Contributions TP-1015G-V. On the right sidebar there is list of calculators for all Canadian provinces where HST is introduced. The calculator include the net tax income after tax tax return and the percentage of tax.

Montant avec taxes Montant TPS et TVQ combiné 114975 Montant sans taxes. Provinces and Territories with GST. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate. Lets calculate this value. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances.

Amount without sales tax x HST rate100 Amount of HST in Ontario. To calculate the sales tax amount for all other values use our sales tax calculator above. The guide contains information about how to make source deductions and how to remit and report source.

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Quebec Sales Tax Calculator On The App Store

Vermont Sales Tax Calculator Reverse Sales Dremployee

Quebec Sales Tax Calculator Apps On Google Play

![]()

Sales Tax Canada Calculator On The App Store

![]()

Quebec Sales Tax Calculator On The App Store

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Gst Calculator Goods And Services Tax Calculation

3 Things We Wish We Had Done When We Had More Money Debt Management Mortgage Calculator Debt Management Plan

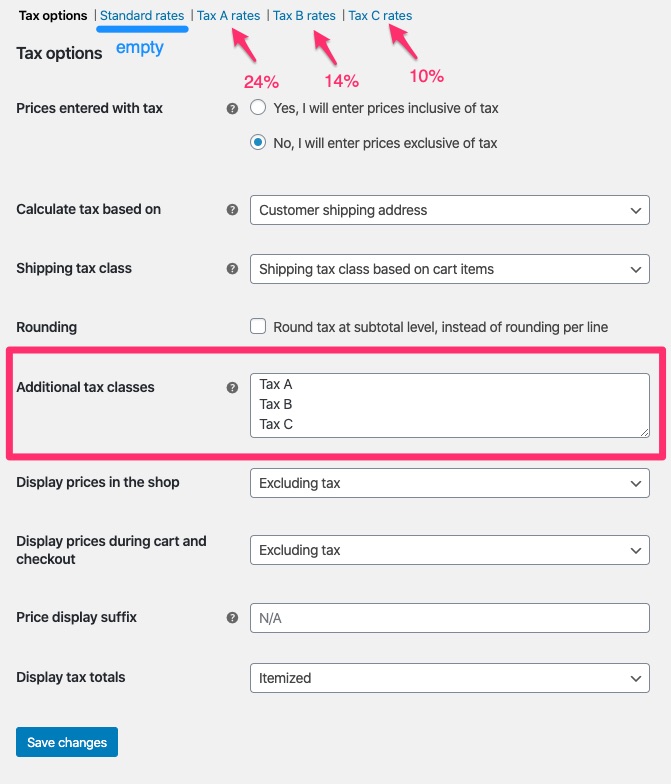

Setting Up Taxes In Woocommerce Woocommerce

Pst Calculator Calculatorscanada Ca

Quebec Sales Tax Calculator Apps On Google Play

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Quebec Tax Calculator Gst Qst Apps On Google Play

Quebec Tax Calculator Gst Qst Apps On Google Play

Canada Sales Tax Calculator By Tardent Apps Inc